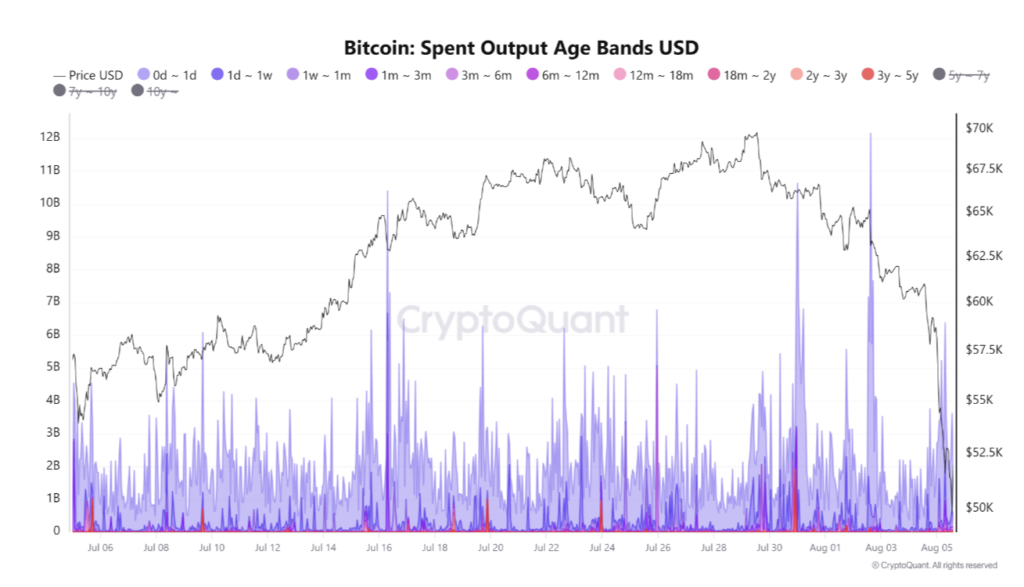

On 5th of August cryptocurrency market suffered heavy losses in terms of decreasing its market capitalisation as global market meltdown sparked the first major selloff for Bitcoin since it went mainstream via ETFs earlier this year. Investors pulled nearly half a bilion dollars of cryptocurrency-linked funds right after Bitcoin experienced a flash crash to $49,500. In total there was around 1.2 bn $ liquidated from the cryptocurrency market in just 24 hours. Despite that we find there is not an obvious reason to mournfulness. What data analytics justifies is that that was one of those events where short term holders just moved its capital to long term holders once again. That is to be seen for instance on data from CryptoQuant that revealed a stark contrast between Bitcoin hodler cohorts. While short-term investors panicked, selling billions in coins, long-term holders held their ground. The majority of coins sold during the crash were less than a week old, indicating a high level of speculation. Long-term holders, defined as those holding Bitcoin for over 155 days, showed resilience during the market downturn. Despite massive amounts in realized losses, the impact on long-term holders was minimal regardless the fact that at first the high volume of loss-making transactions has raised concerns among market analysts whether that may have become a premature end of a bull market.

The vibes however in the crypto space started to improve not that long after. Bitcoin’s price has rebounded remarkably on 6th of August morning showcasing turning up demand, and even though the uncertainty remains about the market’s future direction after that local calamity that took us by surprise yesterday there is a great confidence that Bitcoin and cryptocurrency market will thrive in the next weeks to come with favouring seasonality and greater institutional adoption overall.